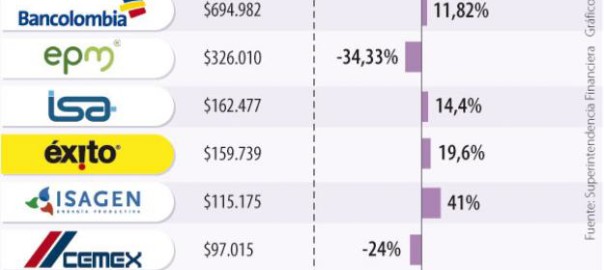

Bogotá. So far, the greatest growth in earnings was Tecnoglass, showing an increase of 368.7% to record a figure in June of $ 8.281 million, followed Isagen with a rise of 41% and success that rose 19.6%. However, the largest amount recordedwas Ecopetrol with $ 1.6 trillion; followed by Bancolombia, with $ 694,982,000 and EPM with $ 326,010 million.

Cecilia López Montaño, former director of National Planning, said that “although there are still doubts as to whether or not sell ISAGEN, the energy sector is still profitable. I am in favor of keeping ISAGEN, and to some extent increase the debt quota, but to make decisions a thorough analysis is necessary.

“Moreover, in the second quarter of 2015, ISA showed an increase in net profit of 14.4% compared to the same period of the previous year. These results, according to the company, are explained by higher revenues on electricity transportation, road concessions and telecommunications, lower interest expenses in Chile and the effect of converting the financial information.

Luis Francisco Cuestas, a professor at Politécnico Grancolombiano University, said that when the resulting indexes of consumer confidence are analyzed, it shows that Colombians still think that the country is not in serious trouble.

“There is eagerness to buy products, but the economy could change with such a high dollar to peso exchange rate. For some people it is a moment to stop purchasing things. Then the heavy borrowing for home appliances implies that power generation remains a profitable business, “said Cuestas.

Another company that posted positive numbers was Bancolombia. In the second quarter it had an increase in net profit of 11.8% to $ 694.982 million compared with the same period last year. In addition, net interest income increased 18.6% from what was posted last year.

The results of Pacific Exploration and Production Corporation a Canadian oil company, involved a net loss of US $ 226.37 million, which according to the company “are reflected in the significant impact of the reduction in the price of crude oil. Other non-cash items affecting earnings include the depletion, depreciation and amortization of expenses, risk management and unrealized losses on currency exchange “.

The next meetings

Next September 4th Ecopetrol will hold a special assembly to officially appoint the new chairman of the board which will be headed by Luis Fernando Ramirez.

The Superfinanciera reported that Banco de Occidente, also convened its shareholders to an ordinary meeting on September 17.

Source: La República